We pursue a sustainable growth strategy aimed at creating value for all stakeholders. We strive for operational excellence, product innovation and sustainability as key tools to continue to grow and generate value over time.

The 2024-2026 Industrial Plan

The 2024-2026 Industrial Plan, presented to our shareholders on 8 February 2024, by placing ESG at the heart of our strategy, leverages on five strategic priorities: sustainability, innovation, competitiveness, growth & positioning, valuing people.

Our decarbonization path

Cementir has given a strong acceleration to its sustainability commitment by further reducing its CO2 emissions targets in the updated decarbonization Roadmap to 2030, which will embrace new technologies such as Carbon Capture and Storage (CCS). The new Industrial Plan includes around 100 million Euro of sustainability investments in the period 2024-2026, distributed across the value chain and centered on four main categories: a) increase usage of alternative fuels and raw materials; b) low carbon cement and innovative green solutions; c) process efficiencies and recycling; d) digitization of key processes

100 million sustainability investments in the next three years CO2 reduction target of 36% in grey cement and 19% in white cement by 2030 (vs 2020 baseline) | |||

| Alternative fuels and renewable raw materials | Low carbon cements | Operating efficiencies and Circular economy | Digitization of key processes |

|

|

|

|

2024-2026 Industrial Plan strategic priorities

-

Sustainability and target of CO₂ emissions reduction by 2030

Cementir is committed to achieving carbon neutrality by 2050, defining sustainability objectives consistent with those of the United Nations to promote the circular economy, reduce the impact on the environment, give value to people and communities, and promote health and safety in the workplace. These ESG targets are embedded in the Group strategic objectives and management’s incentive schemes.

The Roadmap to 2030 has been updated, and the objective of reducing Scope 1 CO2 emissions to 460 kg per ton of grey cement, an emission level lower than the limits imposed by the European Taxonomy, has been confirmed. For white cement, a niche product for specific applications, the plan is to reduce emissions to 738 kg per ton by 2030.

The levers to achieve these new objectives are, among others, the reduction of the clinker content in cement, the greater use of less polluting or alternative fuels, the optimization of thermal efficiency. The 2030 Plan assumes the implementation of a carbon capture and storage (CCS) technology both in Denmark, where the Group has started a second pilot project financed in part by the Danish Innovation Fund, and in Belgium.

In the three-year period 2024-2026, the Group expects to invest approximately EUR 100 million in sustainability projects including: preliminary studies for CCS in Denmark and Belgium; the kiln upgrade at the Belgian plant to increase the use of alternative fuels from the current 40% to over 70%; the transition to natural gas in some of the Group's plants, the preparation of the structures necessary for the production of FUTURECEM® in Denmark, the increase in the use of alternative fuels in Türkiye and other projects to reduce the climate impact of transport, procurement, logistics and the optimization of water resources usage in the production process.

In the renewable energy sector, the Group has signed long-term Power Purchase Agreements (PPAs) with renewable energy producers for the direct purchase of electricity from renewable projects and is evaluating the production of renewable energy from wind farms and/or solar in plants.

-

Innovation

The Group will continue to increase the production of new low carbon cements and other sustainable and high added value products such as FUTURECEM®, which allows to reduce the clinker content in cement and therefore reduce CO2 emissions by approximately 30%. In addition to the aforementioned pilot projects for Carbon Capture, Usage and Storage, with the participation of leading industrial and technological partners, other initiatives include the adoption of artificial intelligence solutions in the production, commercial and supply chain sectors.

-

Competitiveness

The Group will continue to implement a series of actions to further improve the profitability and operational efficiency of manufacturing and logistics processes, with process digitization initiatives, preventive and predictive intelligent maintenance, advanced production control systems, intelligent logistics, warehouse management and integrated digital sales planning.

-

Growth and positioning

Cementir will continue to invest in strengthening vertical integration and its competitive position in the Nordic & Baltic, Belgium and Türkiye areas, as well as consolidating its global leadership in white cement with targeted actions in strategic markets. The Group will also be ready to seize potential external growth opportunities in the core business.

-

Valuing People

The Group's objective will be to further promote the culture of health and safety, further improving the results achieved with the initiatives envisaged by the Zero Accidents program. It also intends to promote diversity and inclusion, the development of human capital and the valorization of skills and evaluation and remuneration policies to improve individual performance and that of the entire organization.

Performance and financial targets of the 2024-2026 Industrial Plan

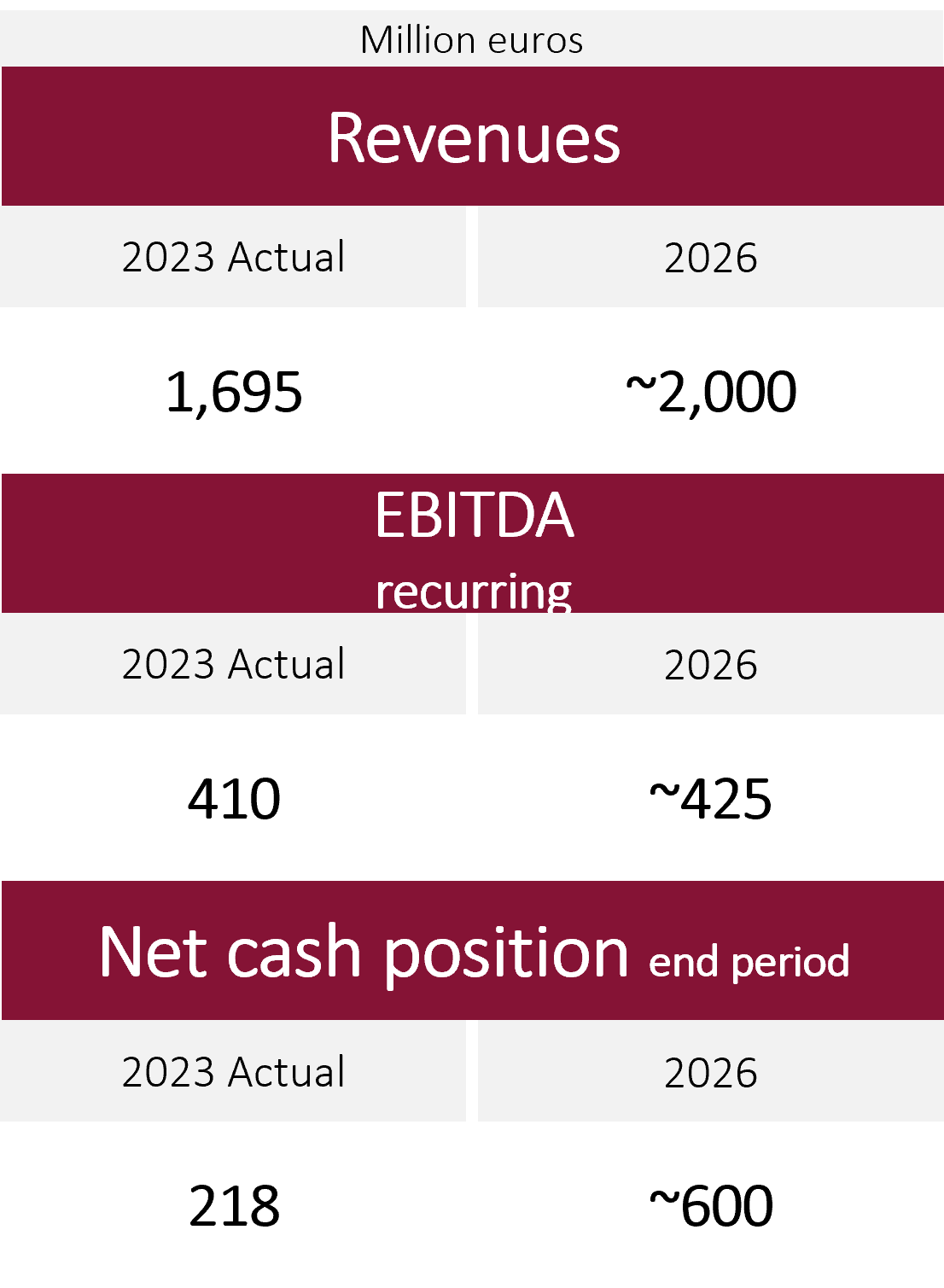

The Plan envisages the achievement of the following 2026 targets, which exclude IAS 29 impact and non-recurring items:

- Revenue up to approx. EUR 2 billion, with a compounded annual growth rate (CAGR) of 5-6%. Over the period of the Plan, a moderate increase in sales volumes of cement, ready mixed concrete and aggregates is expected, with more marked growth in 2024 in all geographical areas with the exception of China, which is expected to remain stable over the three-year period. Prices are expected to be stable or slightly higher on average.

- EBITDA of approx. EUR 425 million, with a compounded annual growth rate (CAGR) of 1.2%. A non-homogeneous trend is expected in the different geographical areas and, in particular, a normalization of Turkey's contribution. Among the Plan's assumptions, we highlight: the capacity optimization in Egypt with the restart of the second kiln and in Belgium as a consequence of kiln 4 upgrade; the increase of fuels and electricity costs, and an average yearly CO2 shortage of approximately 250,000 tonnes which includes a step up in 2026 due to the reduction in the free allocation of emission allowances at the European plants. EBITDA margin will stand at a lower level than that recorded in 2022-2023.

- Average annual investments of approximately EUR 80 million for the development of production capacity, maintenance of plant efficiency, health and safety and digitalization.

- Additional cumulative investments in sustainability of EUR 100 million for projects enabling a reduction of CO2 emissions in line with the Group’s objectives.

- Net cash position of around EUR 600 million by 2026 year end, resulting from cash generation of over EUR 500 million before dividend distribution.

Finally, the Plan assumes the distribution of aa increasing dividend, corresponding to a payout ratio between 20% and 25%.

IP 26